The MT4 Currency Strength Meter

The MT4 Currency Strength Meter

INTRODUCED BY CYNTHIA

OF DAY TRADE FOREX

Use the MT4 Currency Strength Meter to find trades so you don’t have to search the market for hours looking for the right setup…it makes finding trending pairs a breeze. At a glance, you’ll know what pairs to go look at.

BIG PROBLEM FOR FOREX TRADERS:

Finding strong trending pairs to trade is always time-consuming and not easy.

Following currency strength is a very important aspect if you plan to be a successful forex trader.

Currency markets are influenced by macro economic events, and move differently than any other asset.

This MT4 Currency Strength Meter is now the most important item in my trading toolbox.

I rely 100% on using it for determining pairs to look at to potentially trade.

I use the MT4 Currency Strength Meter to find trades even AFTER a big move has taken place. By using the CSM, you can find the pairs that are still trending strongly but in a pullback… I teach how to find the pullbacks and trade the retracements when the trend resumes. Using the CSM is indispensable for this.

This means that you could be sleeping when a big trend starts and you’ve missed the best entry. But hours later, if the trend is still strong but in a pullback, you can use the CSM to find a re-entry. This makes scalp or day trading possible around the clock.

Using the CSM only takes as little as 3 minutes a day to plan your trades.

Every forex trader needs to learn how to use a Currency Strength Meter…I make it easy!

Here’s a short 2 min intro video to show you why I think it’s important to learn how to use a CSM:

If you need help finding trending pairs to trade, please read on.

SOLUTION FOR FOREX TRADERS

What is a Currency Strength Meter?

Imagine you could know which currency is moving the strongest at the moment?

Now what if you could also know the weakest currency at the same time?

You would therefore be able to buy the strong one while selling the weak one. This trade will have the most momentum and highest probability.

A Forex MT4 Currency Strength Meter looks at the 8 common currencies and evaluates the strength/weakness level for each individual major currency, in real time.

In simple terms, a Currency Strength Meter helps you find the biggest movers against peers. We always look to pair the weakest currency with the strongest currency so that the probability of continuation is at the highest possible point.

By using a currency strength meter you can trade the active market momentum and avoid all the chop and head fakes.

Understanding a Simple, Powerful Truth:

When it comes to trading currencies, the only objective we have is to pair a currency that is losing value with a currency that is gaining value in order to create a match up that moves in a given direction.

In other words, if the Euro is gaining value (strong) while the USD is losing value (weak) then the EUR/USD is going to move upward exponentially which creates profit potential.

There are four main trading applications for a CSM:

1. Buy strongest currencies against weakest currencies (long momentum trades)

2. Sell weakest currencies against strongest currencies (short momentum trades)

3. Sell strongest currencies against weakest currencies (fading strong momentum, otherwise known as reversal trading, not advised for new traders)

4. Buy weakest currencies against strongest currencies (reversing weak momentum, otherwise known as reversal trading, not advised for new traders)

A Problem with Trends

We know that it’s the difference in strength between currencies that creates movement that is required to make money in the currency markets, BUT it is incredibly difficult to scan through price charts and determine which currencies are the best to pair with one another (by looking at pair charts, you don’t actually know which currencies are truly gaining value because it is all relative).

After all, how do we know if the EUR/USD is rising because the Euro is gaining value, the USD is losing value, or both?

The real conundrum here is that if the EUR/USD is only rising because the Euro is gaining value, for instance, then if the Euro quits gaining value the pair will quit rising; whereas, if the EUR/USD is rising because the Euro is gaining value and the USD is losing value, the Euro could lose strength but the pair could continue to rise solely on the USD continuing to remain weak.

So, as you can see, it’s essential to pair the right currencies if you want the best chance of success.

Currency Strength Meter – Conclusion

These days the global currency markets are interconnected, and you should be following the relative momentum using a Currency Strength Meter.

Therefore, it is not about deciding whether or not you need to use one, but HOW to implement it to your strategy.

It is, in short, an indispensable tool in trading, as it will show you an at-a-glance view of the current market conditions, allowing you to make timely decisions while taking advantage of strong current market trends…

If you are a momentum trader, this MT4 Currency Strength Meter is gold for you.

Faders and scalpers will also find value in this tool on the lower time frames.

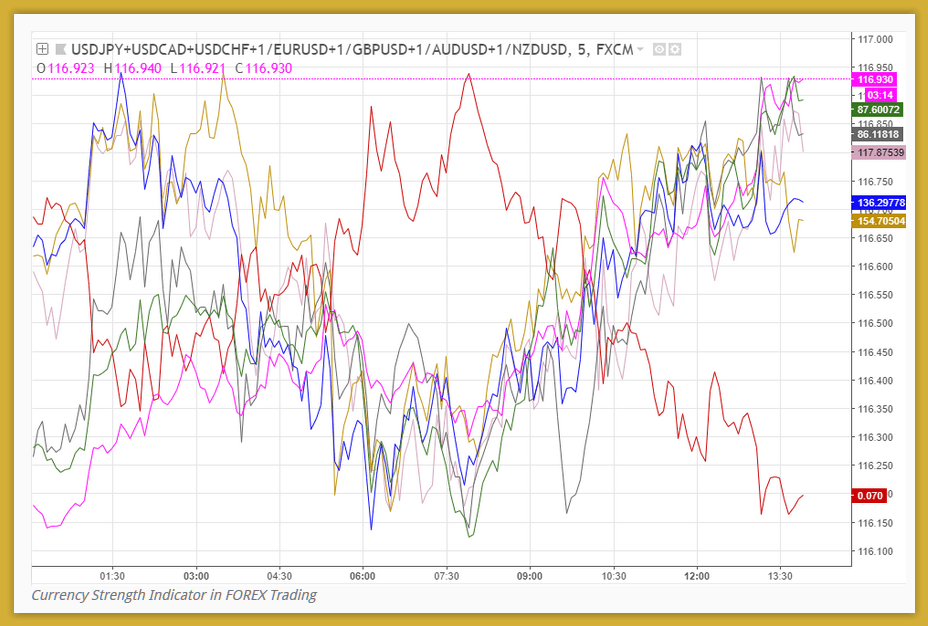

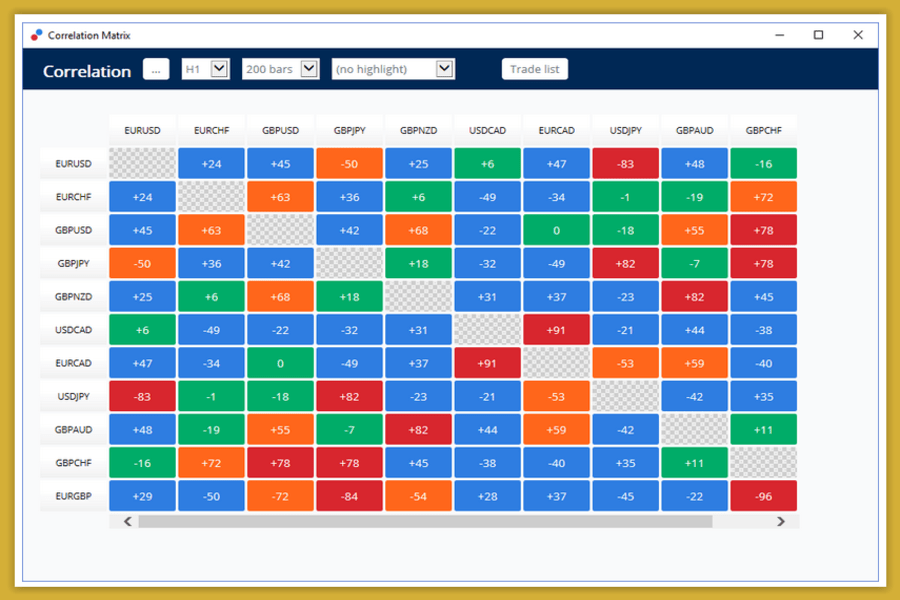

Here are two pictures of some typical-type Currency Strength Meters:

Umm….not what I’d call at-a-glance CSM…I remember about 10 years ago when this was the first type CSM on the market and it sold for $10,000….not for me then, and not for me now:

This is a CSM that is actually a correlation matrix chart…again, not so great at seeing at-a-glance what pairs to go look at:

Quit Guessing About Currency Strength!

What if there was a tool that instantly told you which individual currencies were the strongest and weakness so you could effortlessly choose the correct pair at-a-glance?

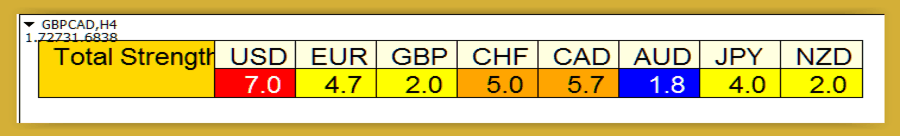

Here’s a pic of the CSM I like the best, this is what I call at-a-glance simplicity…once you learn about the simple color value correlations, it’s super easy to use and with a glance of about 2 seconds, you’ll know what pairs to go look at:

The color code used in the meter is pretty self-explanatory:

BLUE is very weak (0.0 ~ 2.0)

YELLOW is weak (2.0 ~ 5.0)

ORANGE is strong (5.0 ~ 7.0)

RED is very strong (7.0 ~ 9.0).

In the picture above, the GBP is a weak yellow at 2.0 and the CAD is a strong orange at 5.7, so the GbpCad is selling off, the trend is down for this pair.

Also the AudUsd pair is being sold because the AUD is a very weak blue 1.8 versus a very strong USD red 7.0.

We sell the weaker currency (AUD) and buy the stronger currency (USD), but as a pair….so the CSM helps us see this.

Once you start using the CSM, it gets very easy to see at-a-glance, which pairs to go look at. This saves you an incredible amount of time, no more flipping thru dozens of charts looking for a pair to trade, getting confused, and getting it wrong 99% of the time!

It doesn’t matter what time frame you put the meter on because it’s not reacting to the time frame, it’s reacting to the immediate strength or weakness of all the 8 major currencies.

Don’t worry, it’s much easier than you think! It just takes some practice in a demo account.

Here’s a short 8 min intro video explanation of how to use the Currency Strength Meter:

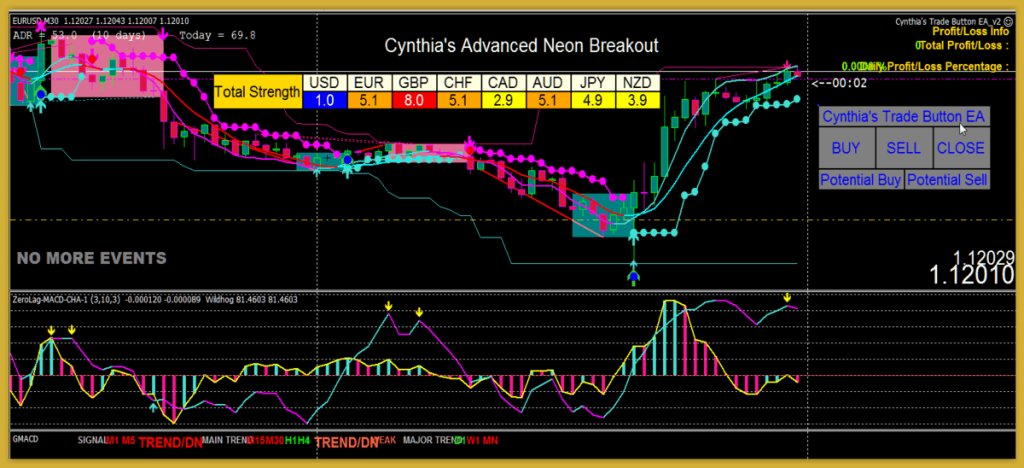

You can and should look at charts with indicators, at the monthly, weekly, and daily levels, to see if the current trend is long term and strong, or short term and weak…it can make all the difference. The indicator in the very bottom window is a multi-time frame indy showing the M1 through Monthly trends, at a glance.

The CSM is showing you current values and as such, is best used for scalping or day trading…but if you like to swing trade, you’ll have to confirm the major trend in the higher time frames and use the CSM to get the best entry after a pullback…so in other words, you can use the CSM in the higher slower time frames for retracement trading, using the lower faster time frames for trading the retracements to get the best entry after the retracement is over and the major trend resumes.

The MT4 Currency Strength Meter Template can be used as a stand-alone trading system or the CSM indicator can be used alone with any other trading system.

YOU HAVE A CHOICE BETWEEN THE INDIVIDUAL CURRENCY STRENGTH METER INDICATOR, OR IF YOU WANT MY ADDED INDICATORS, A BASIC CSM TEMPLATE OR A PRO ADVANCED CSM TEMPLATE.

You can use the individual CSM indicator on any trading system that you currently favor. OR you can buy my Basic or Pro template that has some of my favorite indicators that I use. The CSM PRO template also includes my One Click Trade Button/Trade Manager with preset files for currencies and CFDs.

HERE IS THE BASIC MT4 CURRENCY STRENGTH METER TEMPLATE

You can see that the USD is a strong red at 7.1 and the CAD is a weak blue at 1.1, and for several hours and on the last candle, the trend is up as traders are buying the USD and at the same time selling the CAD…so the USDCAD has been going up, due to a weak CAD news report:

HERE’S THE PRO ADVANCED CSM TEMPLATE ON A GBPUSD H1 CHART OF A NON-FARM PAYROLL AND USD: ISM RED NEWS FRIDAY:

If you look at the CSM, the USD is a very weak blue 1.0 against a very strong red GBP at 8.0, so at the end of the day, after NFP, the GbpUsd is still strongly up BECAUSE THE USD IS STILL VERY WEAK and the GBP IS STILL VERY STRONG. At the last candle, you can see the the GbpUsd trend is still up after 9 hours and has hit the top of the fibonacci red overbought zone, after pushing past the fibonacci pivot line and fib resistance levels 1, 2, and 3.

If you look at the CSM, the USD is a very weak blue 1.0 against a very strong red GBP at 8.0, so at the end of the day, after NFP, the GbpUsd is still strongly up BECAUSE THE USD IS STILL VERY WEAK and the GBP IS STILL VERY STRONG. At the last candle, you can see the the GbpUsd trend is still up after 9 hours and has hit the top of the fibonacci red overbought zone, after pushing past the fibonacci pivot line and fib resistance levels 1, 2, and 3.

Buy the stronger currency AND Sell the weaker currency, as a pair.

Non-Farm Payroll (NFP) and USD: ISM red economic news events can really move the markets…and not just the USD crosspairs, and the first 30 minutes usually see large swings up and down…what’s called a ‘whipsaw’… generally the first 30 minutes should be avoided, unless you’re a very proficient trader and can trade in the 1 min/5 min/15 min set up.

THE PICTURES BELOW SHOW HOW I’VE ADDED THE INDIVIDUAL CSM INDICATOR AND MY NEW TRADE BUTTON/TRADE MANAGER TO SOME OF MY COLOR CODED TRADING SYSTEMS.

EXAMPLE OF THE CSM INDICATOR AND NEW TRADE BUTTON/TRADE MANAGER ON THE ADVANCED NEON BREAKOUT CHART

Here’s a pic of the CSM indicator and my new Trade Button on a Advanced Neon EurUsd M30 chart, and you can see the NFP news event when the EurUsd went up… the EUR is a strong orange of 5.1 and the USD is a very weak blue of 1.0:

Sell the weaker currency and Buy the stronger currency, as a pair.

How to add the MT4 Currency Strength Meter to a chart of any other trading system, using my Basic Neon Breakout as an example:

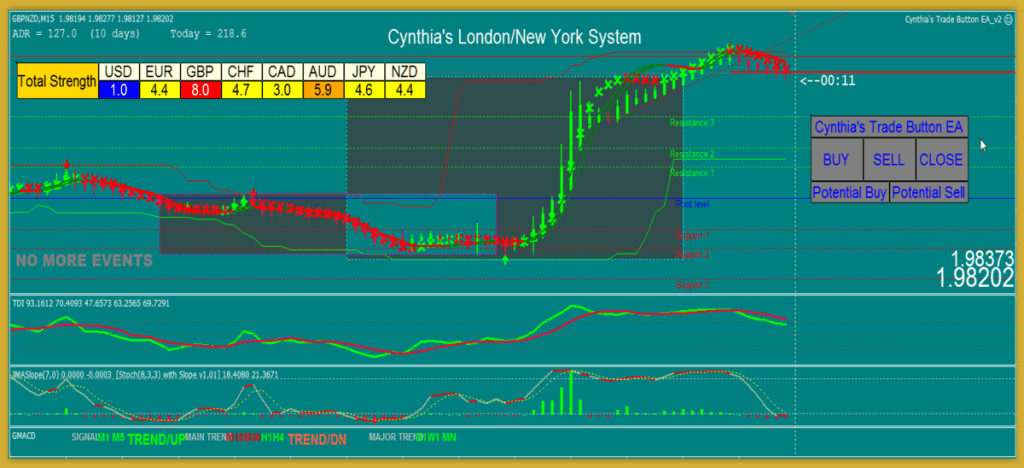

EXAMPLE OF THE CSM INDICATOR AND NEW TRADE BUTTON/TRADE MANAGER ON THE LONDON NEW YORK SYSTEM FEATURING THE GBPNZD M15 CHART:

On the GbpNzd M15 chart above, you can see how the very strong red GBP 8.0 combined with the weak yellow NZD 4.4 has been pushing the GBPNZD pair up.

Buy the stronger currency, Sell the weaker currency, as a pair.

Here’s a video showing you how I use the MT4 Currency Strength Meter on the London New York system template:

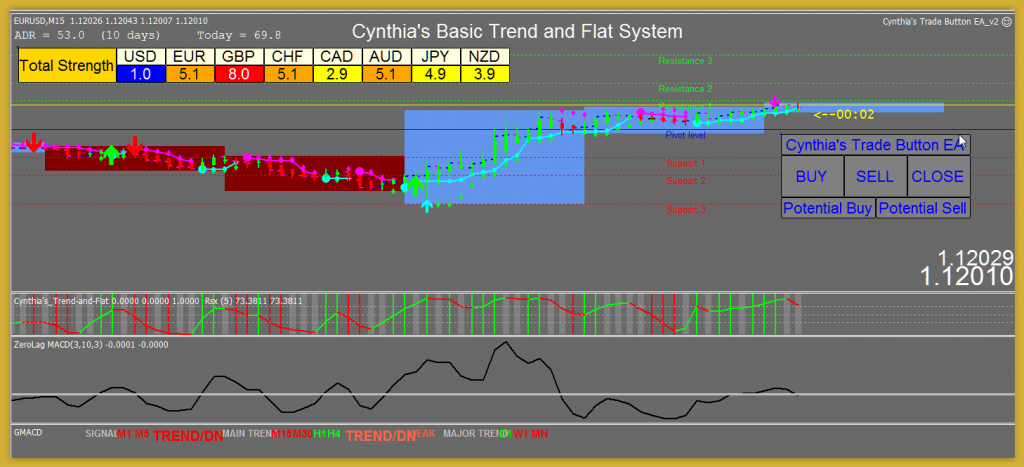

EXAMPLE OF THE CSM INDICATOR AND MY NEW TRADE BUTTON/TRADE MANAGER ON THE BASIC TREND AND FLAT EURUSD M15 CHART:

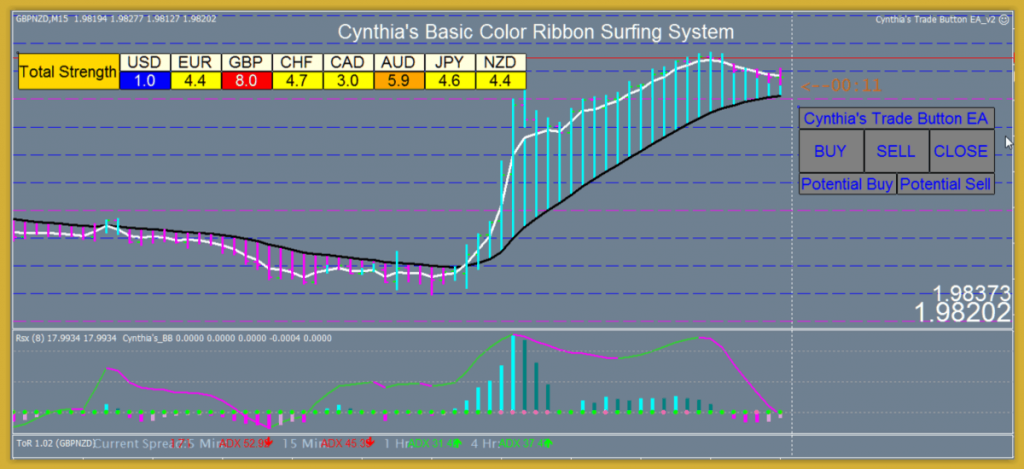

EXAMPLE OF THE CSM INDICATOR AND MY NEW TRADE BUTTON/TRADE MANAGER ON THE COLOR RIBBON SURFING SYSTEM CHART M15 GBPNZD:

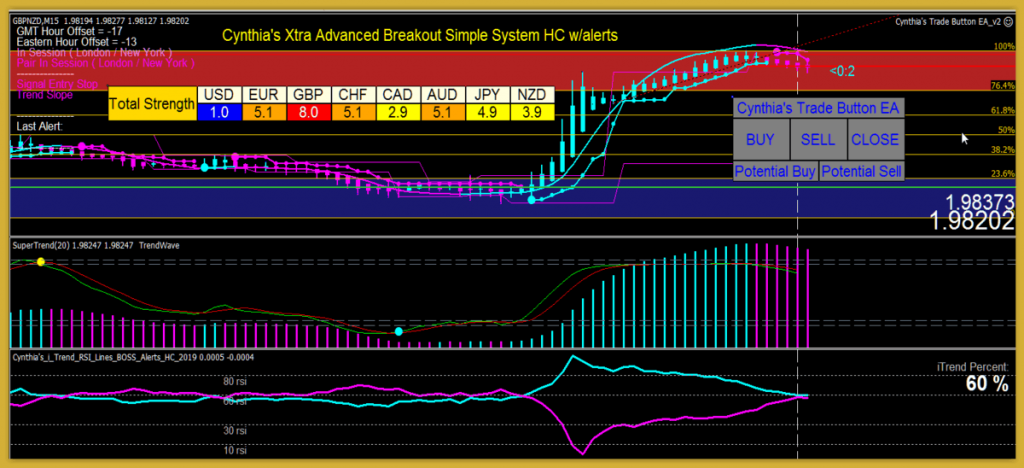

EXAMPLE OF THE CSM INDICATOR AND MY NEW TRADE BUTTON/TRADE MANAGER ON THE XTRA ADVANCED BREAKOUT SIMPLE SYSTEM CHART FEATURING THE GBPNZD M15 CHART:

As you can imagine, using a CSM is a huge advantage when it comes to taking advantage of the most powerful market trends.

The CSM works with tick data and changes all the time, it may not be very accurate in backtests, but if you just want to see where the market is at in any given point of time, it gives a clear immediate picture.

Of course, one word of warning, as with everything Forex, there is no absolute. These methods have shown to work in the past, and it is relatively reasonable to expect them to work in the future, but of course, there is no guarantee…

Even if sometimes all conditions are right, these methods may not work due to other factors, such as unscheduled (or even scheduled) news releases, market sentiments, order flows, etc… that are beyond the scope of these methods, so always use caution and most of all, common sense, when using the CSM.

I’ve found that using the CSM is effective over 80% of the time, and that is considered great odds for Forex… So feel free to trade it on demo accounts first, and give it time to practice, you’ll thank me later.

To keep abreast of red economic news events that can drastically affect the readings of the CSM values, please always watch the Forex Factory Calendar:

https://www.forexfactory.com/calendar.php

Use the filter to set up the calendar for your timezone and filter only the red news events.

You can watch the CSM before a red news event and then see the changes in values after the red news event…look at the higher time frames to see if the major trend is the same or has changed…trade the pullbacks using the CSM and your indicators to time your entry after the pullback is over.

Taking Advantage of the MT4 Currency Strength Meter

The key regarding the Currency Strength Meter is making sure that you combine the individual strength with other components because, of course, strengths are always fluctuating.

You won’t always win by just matching the strongest currency with the weakest one and clicking “Buy”, because of the constant fluctuation in the market.

I suggest using things like RSI, MACD, trend lines, channels, fibonacci retracements, support and resistance zones, divergence, etc., in order to enhance the timing of your entry when matching up the currencies.

Also, it’s important to use your trading system to look at the major monthly, weekly and daily trends, to see if the trend is long term or short term…it’s important to know this.

Use the Currency Strength Meter to find trades so you don’t have to search the market for hours looking for the right setup… it makes finding trending pairs a breeze.

Once you see a pair to go look at, refine your entry by using other indicators as mentioned. You can’t just use the CSM all by itself, you have to use other indicators. I use the CSM to trade any of my own color coded trading systems, each with unique indicators…but in my training videos I use my Neon Breakout system.

Using the CSM only takes as little as 3 minutes a day to plan your trades.

Every forex trader needs to learn how to use a Currency Strength Meter… I make it easy!

IMPORTANT!

You have a choice of how to purchase the MT4 Currency Strength Meter:

I SELL THE CURRENCY STRENGTH METER INDICATOR WITHOUT ANY TEMPLATE OR ANY OTHER INDICATORS FOR ONLY $47. THIS CHOICE IS THE BEST FOR TRADERS THAT ALREADY HAVE A FAVORITE MT4 TRADING SYSTEM AND JUST WANT THE METER BY ITSELF.

CLICK HERE to visit the page to purchase the individual CSM indicator for $47.

I ALSO SELL MY NEW TRADE BUTTON BY ITSELF FOR ONLY $97. THIS NEW TRADE BUTTON COMBINES THE FUNCTIONS OF ORDER PLACEMENT AND TRADE MANAGEMENT, WITH JUST ONE CLICK. IT INCLUDES PRESET FILES FOR CURRENCIES AND CFDS.

CLICK HERE to visit the page to purchase the individual Trade Button for $97.

I ALSO SELL THE CURRENCY STRENGTH METER WITH A TEMPLATE THAT INCLUDES SOME OF MY OTHER FAVORITE INDICATORS….YOU HAVE THE CHOICE BETWEEN THE BASIC TEMPLATE AND THE PRO TEMPLATE.

THE CSM PRO TEMPLATE INCLUDES MY CSM AND NEW TRADE BUTTON/TRADE MANAGER, AS WELL AS SOME EXTRA INDICATORS I REALLY LIKE.

While the Basic CSM is great, some traders might really like the Advanced PRO features.

It’s especially important because of the Fibonacci red overbought and blue oversold zones AND the One Click Buy, Sell, Close Trade Button/Trade Manager that’s only in the PRO CSM Template.

PLEASE WATCH A VIDEO WHICH COMPARES THE BASIC CSM TEMPLATE WITH THE PRO CSM TEMPLATE :

The Basic CSM Template is a cool non-refundable $77…

Please click the link below if you would like to purchase the BASIC CSM for $77, which includes my special template with some of my favorite indicators… Note: this template does not include the Trade Button/Trade Manager:

CLICK HERE to visit the Basic CSM page to purchase the basic CSM template for $77.

BUT WAIT!

SPECIAL INTRODUCTORY OFFER!

Purchase the PRO CSM and get EVERYTHING….including the NEW Trade Button Trade Manager AND the template loaded with more of my favorite indicators!

If you would like to purchase the PRO CSM for only $147, you get more of my favorite indicators AND my ONE CLICK BUY, SELL, CLOSE TRADE PLACEMENT BUTTON which INCLUDES MY TRADE MANAGER TRAILING STOP AND the currency and CFD set files… please click below:

CLICK HERE to visit the PRO CSM page to purchase for $147.

THIS PURCHASE INCLUDES THE CSM AND THE TRADE BUTTON/TRADE MANAGER AND ALL THE OTHER INDICATORS ON THE PRO CSM TEMPLATE!

Normally, the CSM INDICATOR alone is sold for $47 and the TRADE BUTTON alone is sold for $97, and neither of these come with a template loaded with some of my favorite indicators… you can buy the Basic CSM template for $77 which has some of my favorite indicators but NOT the new Trade Button Trade Manager….but if you order the PRO CSM template now you get EVERYTHING, including the trading template loaded with all of my favorite indicators, PLUS the NEW Trade Button Trade Manager, for only $147….YOU GET EVERYTHING! THIS IS THE BEST DEAL FOR YOU!

NOTE:

You can use the CSM template as a stand-alone trading system, OR, you can use the CSM indicator without the template, with any other trading system that you like.

If you are interested in trading with any of my other color coded MT4 trading systems, please visit my main website:

If you have questions or need support, you can reach Cynthia here:

currency.strength.meter.assist @ gmail.com

(remove the spaces)

To your trading success!

Cynthia

Trading From the Beaches of Mexico…. You can too!

NFA Required Disclaimer: Forex trading may not be suitable for all customers. Forex trading involves a substantial risk of loss. Simulated conditions may differ from real conditions and traders should not necessarily expect the same results from live trading.

DISCLAIMER: The information on this site is for educational purposes only. Trading is risky and is not suitable for everyone. Only risk capital should be used. You are responsible for your results and agree to hold everyone else harmless if you lose. You agree to hold harmless all principles, affiliates, and associates from any trading losses or any other harm due to trading.

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.